3350 Noble Way, Suite A

WEEK IN REVIEW

Last week, markets finished up again for the second week despite negative news on the inflation and economic demand.

- The S&P 500 was up 0.55%

- The Dow Jones Industrial Average increased by 1.14%

- The tech-heavy Nasdaq Composite led broad equity markets finishing up 1.43%

- The 10-year Treasury closed at 4.50%

Consumer confidence for the month of April was gauged on Tuesday through the Conference Board’s Consumer Confidence measure. The reading came in under expectations at 97, continuing the current trend of declining confidence in the economy. That same day, the American Petroleum Institute (API) released their weekly crude oil stock measurement, coming in higher than anticipated, implying a weaker demand for oil.

Wednesday, ADP published their National Employment Report measuring the monthly change in non-farm, private employment, based on their clients’ payroll data. May’s reading came in stronger than anticipated, depicting a bullish labor market. Additionally, the Job Openings and Labor Turnover Survey (JOLTS) reported on the current job vacancies, collecting data from employers regarding their employment status and job postings. May’s reading is the second consecutive month that came in lower than anticipated. Economists will be on the lookout to see if this trend continues.

On Thursday, the Nonfarm Productivity measure was released, annualizing the change in labor efficiency when producing goods and services. The reading for the end of Q1 shows a decline in productivity with a reading of 0.3% compared to the previous reading of 3.2%, and lower than the anticipated 0.8%.

Concurrently, unit labor costs were also released, annualizing the change in prices that businesses pay for labor, which is a leading indicator of consumer inflation. The reading came in hotter than anticipated at 4.7%, depicting a bullish market.

Concluding the week on Friday, the average hourly earnings for the month was released, measuring 0.1% less than the previous reading at 0.3%. Furthermore, the unemployment rate revealed a 0.1% increase in the total workforce that is not working, but actively seeking employment, indicating a slight decline in the state of the job market.

SPOTLIGHT

Inflation Strikes Back?

With last week’s Purchasing Managers’ Index (PMI) print showing higher prices paid by manufacturing and concerns of reaccelerating inflation, investors were particularly focused on what was dubbed by some in the media as “the most important Fed decision of the year.” But as we look deeper, we see a Fed that is looking ahead beyond the current noise of month-to-month inflation volatility and preparing for future rate cuts.

First to the bad news – on Wednesday, the Institute of Supply Management (ISM) Manufacturing PMI Report indicated that prices paid index had surged in April for manufacturers to an index level of 60.9 from 55.5.

This was a near two-year high for manufactures and paired with a decline in overall manufacturing number (49.2 from 50.3), sent a shockwave of fears through investors of declining demand paired with higher prices. Whispers of stagflation are becoming more and more common as the market fears a declining demand in the economy, with stubborn inflation that the Fed has struggled to tame.

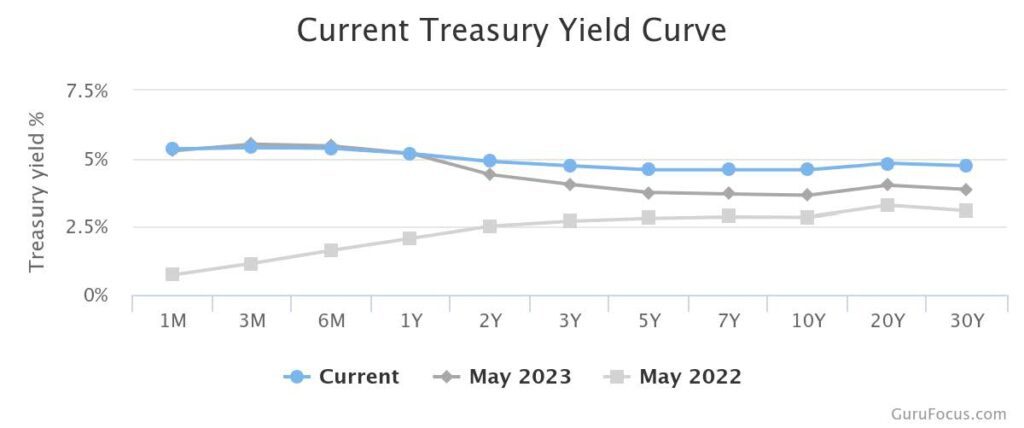

Later in the afternoon on Wednesday, the headlines came out with the Fed’s announcement – rates would remain unchanged at 5.50%. But looking beyond the discount rate, we see a Fed that is starting to become more dovish. The Fed announced that it will curtail its quantitative tightening (QT) program (selling off its assets to decrease money supply and increase interest rates) starting in June. This drop from $60 billion a month to $25 billion a month led to a drop in yields in the 10-year, as well as the stickier 30-year yield. This runoff was seen as aggressive and to some investors signals a Fed that is comfortable with where long-term rates are at and looking to “cap” the long end of the curve. Looking below, we can see how long-term rates have risen slowly but significantly since the beginning of this rate hike cycle.

Source: GuruFocus.com. Rates as of 5/2/2024.

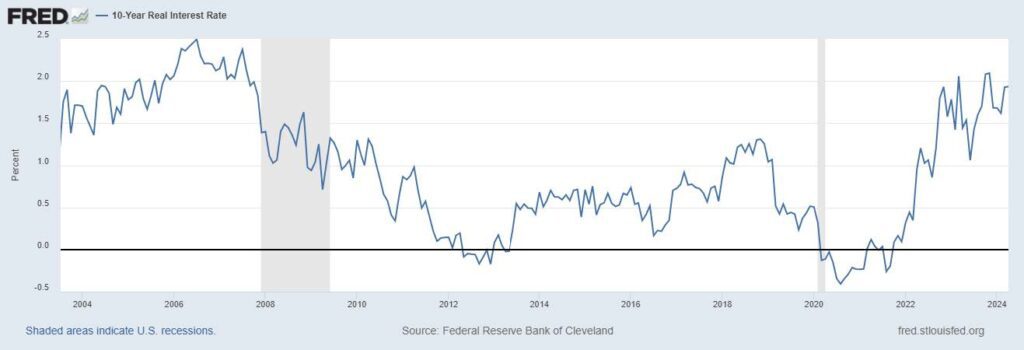

With the 10-year Treasury staying consistently over 4.60% and real interest touching near 2% (the highest since pre-2008), the Fed is preparing to be more dovish long term with easing their balance sheet roll off, while still keeping short term rates high to fight with inflation that continues to reemerge.

Source: FRED. 10-Year Real Interest Rates as of 5/3/2024.

Additionally, the Fed’s reduction in roll off will target specifically U.S. Treasuries, which will be a blessing for the federal government as debt interest payments continue to climb and are expected to be $870 billion this year, exceeding the $822 billion spent on military spending. In short, we are seeing a Fed willing to keep rates high while trying to ease the longer end of the curve. This is hopefully a sign (or a gift) to bond investors that lower rates could still be on the table this year.

THE WEEK AHEAD

This week will provide insights into the current state of the economy with a focus on the labor and petroleum markets, as well as the status of U.S. consumers.

The Conference Board will release the Employment Trends Index for the month of April, measuring the ease of finding a job, becoming unemployed, current job openings, and supply and demand trends in the production and sales industries. Recent readings depict a bearish market due to increasing measures compared to the respective previous month. Additionally, initial jobless claims for the week will be released, stipulating if recent hot market trends will continue.

Changes in outstanding consumer credit for the month of March will be released by the Federal Reserve Board. The previous reading for the month of February showed a smaller change than anticipated, corresponding to an increase in outstanding credit. Furthermore, the University of Michigan will release their Consumer Expectations Index for the month of May, gauging consumers’ expectations of a hot or cold economy. The previous two readings have shown consistent expectations of a decline in the state of the economy. Economists will be on the lookout to see if this trend continues.

Weekly crude oil inventories will be measured by the Energy Information Administration (EIA). An increase in inventories implies a weaker demand, possibly resulting in lower prices, while a decrease in inventories implies an increased demand, possibly increasing oil prices. Additionally, the weekly U.S. Baker Hughes Total Rig Count will measure the number of active rigs, providing an insight into a possible increase or decrease in demand. The previous two readings have shown a decline in the number of rigs.

DISCLOSURES

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0524-1539