3350 Noble Way, Suite A

THE WEEK IN REVIEW

With concerns over a cooling gross domestic product (GDP) number, broad equity indices were down for the week.

- The S&P 500 turned negative, falling 0.51%

- The Dow Jones Industrial Average was down by 0.98%

- The Nasdaq Composite finished lower by 1.10%

- The 10-Year Treasury closed at 4.51%

With markets closed on Monday due to Memorial Day, investors turned their attention to the remainder of the week filled with pertinent economic data points.

Tuesday, the Conference Board released their Consumer Confidence measure for the month of May, which illustrated that consumers are optimistic about the economy. May marked the first rise over the past four months, with a reading of 102 in May, up from 97.5 in April.

The economy’s primary health indicator, GDP, was released on Thursday, coming in lower than the forecasted 1.6% change at 1.3%, indicating a bearish economy.

On Friday, the Fed’s preferred inflation measure, the Personal Consumption Expenditure (PCE) Price Index, measured a 0.3% change in the price of goods and services purchased by consumers for the month of April. This is now the fourth consecutive month measuring at 0.3%, showing no drastic changes from month-to-month. Additionally, personal spending for the month of April was released depicting a significant decline in economic activity from a reading of 0.7% for the month of March down to 0.2% for the month of April. Economists will be watching to see if this trend continues.

SPOTLIGHT

An Early Look at Fund Flows

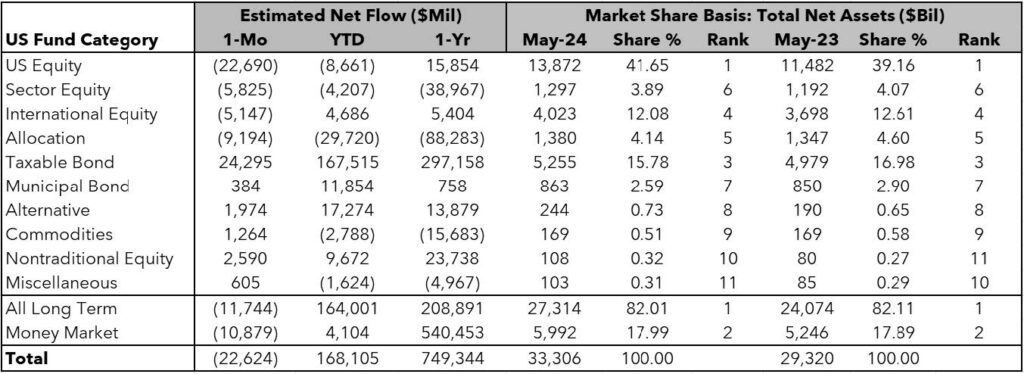

As we move into the last month of Q2, we take a look at fund flows and see how investors are allocating given equity valuations and developments in fixed income markets. Year-to-date, we continue to see investors move from U.S. equities into fixed income broadly in both taxable and municipal bonds.

Taxable bond funds have seen net flows increase $167 billion for the year, accounting for more than the total long term asset net flow allocation of $164 billion. As of the beginning of May 2024, taxable fixed income funds account for $5.25 trillion of total net assets, an increase of 5.2% since May 2023. Despite less flows year-to-date, taxable fixed income continues to lag money markets in rankings, indicating investors are still holding cash on the sideline after money markets accounted for over half a trillion dollars in flow in the last year.

Data as of 5/1/2024. Source: Morningstar Direct. Data includes net flows for U.S. Open-end Mutual Funds, Exchange Traded Funds, and Money Market Funds (excluding Fund of Funds and Feeder Funds).

Equities have had more of a mixed year so far. U.S. equities have seen net outflows, while international equities and nontraditional equities (long-short and derivative income categories) have seen slightly positive flows year-to-date. U.S. equities still hold the crown for total net assets, with market appreciation over the past year helping total net assets grow from $11.4 trillion to $13.8 trillion, accounting for 41% of all fund assets.

As a sign of investors looking to find uncorrelated returns to stocks and bonds, alternatives have seen a reversal in flows year-to-date with flows of $17 billion year-to-date but only $13 billion in the past year. Total net assets in alternatives have grown 28% since May 2023 and are only behind nontraditional equities in net asset growth since that time.

Data as of 5/1/2024. Source: Morningstar Direct. Data includes net flows for U.S. Open-end Mutual Funds, Exchange Traded Funds, and Money Market Funds (excluding Fund of Funds and Feeder Funds).

Finally, we look at active versus passive managed strategies as a whole. After seeing 2022 and 2023 have a revitalization in actively managed strategies, we have noticed a reversal in actively managed strategies in the last month with $39 billion in outflows for actively managed strategies versus a $16 billion inflow for passively managed strategies, resulting in active outflows for the year at $32 billion. Over the last year, passively managed strategies have seen $605 billion in inflow, while active strategies have seen only $143 billion, showing investors have still leaned into passive over active managers when it comes to fund decisions.

Active strategies overall still hold a lead over passive in total net assets with $19.4 trillion versus $13.8 trillion, but have seen their overall share of long-term assets fall below 60% year-to-date.

THE WEEK AHEAD

Turning the calendar to a new month of the year, the upcoming week will provide pertinent data points to facilitate consumers in understanding and interpreting the state of the U.S. economy.

The Manufacturing PMI for May will be released, providing an insight into where the economy currently is in the economic cycle. A reading above 50 suggests expansion for the manufacturing industry, while a reading under 50 suggests contraction. Additionally, the Institute for Supply Manufacturing (ISM) non-manufacturing PMI will be released indicating if the service industry is in contraction or expansion territory as well.

Current labor market conditions will be showcased through the number of current job openings in the Job Openings and Labor Turnover Survey (JOLTS) measure for the previous month. Employers will report about their openings, new hires, and terminations for the month of April. Furthermore, alongside the measurement of current open positions, the change in average hourly earnings will be released for May. A decrease in wages will signal economists to a potential contraction of the labor market. Alternatively, the U.S. Department of Labor will release the number of continuing jobless claims to gauge the number of those unemployed that are unsuccessful in finding employment, requiring unemployment insurance benefits.

DISCLOSURES

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0624-1878